When you pick up a prescription, you might expect to pay a simple flat fee. But if you’ve ever been shocked by a pharmacy bill - especially for a medication you thought was covered - you’re not alone. The reason? Your health plan’s formulary tiers. These aren’t just bureaucratic labels. They directly control how much you pay out of pocket for every drug you take. Understanding Tier 1, Tier 2, Tier 3, and non-formulary drugs isn’t just helpful - it can save you hundreds, even thousands, a year.

What Is a Formulary, Anyway?

A formulary is your insurance plan’s official list of covered prescription drugs. It’s not random. Every drug on that list has been reviewed by your plan’s Pharmacy Benefit Manager (PBM) - companies like CVS Caremark, Express Scripts, or OptumRx - and placed into a tier based on cost, effectiveness, and how much rebate the drugmaker offers. This tier system was created to push patients toward cheaper, equally effective options while still allowing access to more expensive drugs when needed. In Australia, private health insurance works differently. But if you’re in the U.S. (or dealing with U.S.-based plans), this system applies to nearly every commercial plan and all Medicare Part D plans. By 2023, 99.7% of prescription drug plans used some kind of tier structure. The goal? Lower overall drug spending. The reality? It’s confusing, inconsistent, and sometimes unfair.Tier 1: The Lowest Cost - Usually Generics

Tier 1 is where you want to be. This tier is mostly filled with generic drugs - medications that have the same active ingredients as brand-name versions but cost far less because the patent has expired. These are the drugs your doctor can prescribe without a second thought. For most commercial plans, a 30-day supply of a Tier 1 drug costs between $0 and $15. Medicare Part D plans often list Tier 1 copays as low as $0 for certain generics. That’s not a typo. Some plans cover common medications like lisinopril (for blood pressure) or metformin (for diabetes) with no copay at all. Why are these so cheap? PBMs negotiate big discounts with generic manufacturers. Since multiple companies make the same generic drug, competition drives prices down. Your plan encourages you to use these because they save everyone money - including you.Tier 2: Preferred Brand-Name Drugs

Tier 2 includes brand-name drugs that your plan has chosen to favor over others. These are usually newer or more expensive than generics, but your insurer has negotiated a better deal with the manufacturer - often through rebates or volume discounts. You’ll pay more here. Average copays range from $20 to $40 for a 30-day supply. Think of drugs like atorvastatin (Lipitor) or losartan (Cozaar) - still widely used brand names, but covered at a lower cost because the insurer got a good deal. The key word here is “preferred.” That means your plan has a reason to push you toward this brand over others in the same class. Maybe it’s proven more effective. Maybe the manufacturer pays a bigger rebate. Either way, it’s still a better deal than Tier 3.Tier 3: Non-Preferred Brand-Name Drugs

Tier 3 is where things get expensive. These are brand-name drugs with no special deal from the manufacturer. Your plan considers them more costly than alternatives - and they haven’t earned a rebate to offset that cost. Copays here jump to $50-$100 per 30-day supply. In some plans, you might even pay coinsurance - say, 30% of the drug’s total cost - instead of a flat fee. This tier often includes older brand-name drugs that still have patents but have cheaper generic or preferred brand alternatives available. For example, if your doctor prescribes a brand-name statin that’s not on Tier 2, you might pay $80 for a month’s supply - even though a Tier 1 generic costs $10. That’s a $70 difference, every month. That adds up fast.

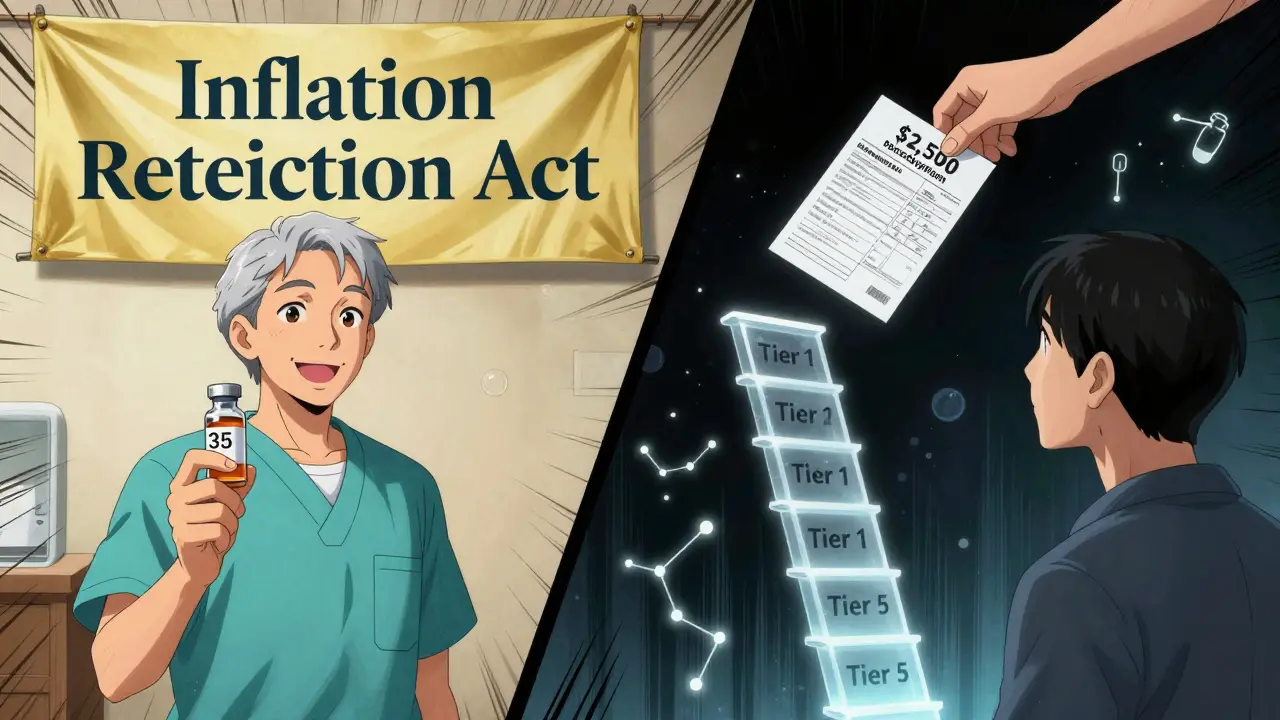

Tier 4 and 5: Specialty Drugs - The Real Cost Shockers

Many plans now use five tiers. Tier 4 and 5 are for specialty drugs - high-cost medications used to treat complex conditions like cancer, rheumatoid arthritis, multiple sclerosis, or rare genetic diseases. These aren’t your typical prescriptions. They often require special handling, injections, or monitoring. And they’re expensive. A single dose of some Tier 5 drugs can cost over $1,000. Cost-sharing here is usually coinsurance, not a copay. You might pay 25%, 33%, or even 50% of the drug’s total price. That means a $5,000 drug could cost you $2,500 out of pocket - unless you qualify for financial assistance. Medicare Part D has a separate specialty tier, but commercial plans often lump these into Tier 4 or 5. In 2023, 68% of commercial plans placed specialty drugs in these top tiers. And 41% of patients reported delaying treatment because they couldn’t afford it.Non-Formulary: Not Covered - Unless You Fight

If a drug isn’t on your formulary at all, it’s non-formulary. That means your plan doesn’t cover it - unless you get an exception. Why would a drug be excluded? Maybe it’s too new. Maybe there’s a cheaper alternative. Maybe the manufacturer didn’t negotiate a deal. Sometimes, it’s just an oversight. If your doctor prescribes a non-formulary drug, you’ll pay full price - which can be hundreds or thousands of dollars. But you’re not stuck. You can ask for a formulary exception. This is a formal request, usually started by your doctor, explaining why you need this specific drug. Maybe you tried all the alternatives and had side effects. Maybe you’re allergic to the Tier 2 version. If your doctor provides medical documentation, your plan must review it - and often approves it. One Medicare beneficiary saved $100 a month after successfully appealing to move a Tier 3 drug to Tier 2 coverage.Why Do Tiers Change Without Warning?

One of the biggest frustrations? Formularies change - often. Plans can update their formularies quarterly. That means a drug you’ve been taking for years could suddenly jump from Tier 2 to Tier 3 - or get kicked off entirely - with only a notice in your mail or online portal. In 2022, 43% of commercial plan members had at least one medication moved to a higher tier without advance notice. That’s not just inconvenient - it’s dangerous. People stop taking meds because they can’t afford the new price. Always check your formulary before refilling a prescription. Don’t assume last year’s copay still applies. Even small changes can cost you hundreds.How to Find Out Which Tier Your Drug Is In

You can’t guess. You have to look it up. Start with your plan’s Summary of Benefits and Coverage (SBC). That’s a short document you get when you enroll. But it doesn’t list every drug. For the full list, go to your insurer’s website and search for “formulary” or “drug list.” You’ll find a downloadable PDF - often over 100 pages long. Use the search function (Ctrl+F) to type in your drug’s name. Medicare beneficiaries can use the official Medicare Plan Finder tool. Commercial plan members can use tools like Humana’s Drug Cost Finder or GoodRx’s formulary checker. These tools show you not just the tier, but the exact copay for your pharmacy. Pro tip: Always check the generic version too. Sometimes, the brand-name drug is Tier 3, but the generic is Tier 1. Your doctor might be able to switch you.

What to Do When a Drug Is Too Expensive

If you’re stuck with a high-tier or non-formulary drug, here’s your action plan:- Ask your doctor: “Is there a Tier 1 or Tier 2 alternative?” Many conditions have multiple treatment options.

- Request a formulary exception: Your doctor submits paperwork proving medical necessity. Approval rates are often above 70% if the case is strong.

- Check for patient assistance programs: Drugmakers often offer discounts or free meds for low-income patients. Visit NeedyMeds.org or the manufacturer’s website.

- Use a pharmacy discount card: GoodRx, SingleCare, or RxSaver can save you 50-80% even on non-covered drugs.

- Call your plan: Ask if they have a “tiering exception” or “step therapy override” process. Sometimes, you just need to ask.

Who Benefits From This System?

The system works - for some. Insurers and PBMs save billions. In 2022, preferred brand tiers generated $14.7 billion in savings through rebates. Medicare Part D beneficiaries in Tier 1 paid just $1.27 per generic prescription, while Tier 3 brand-name drugs cost $58.72 on average. But patients? The data shows a split. People on generics are happy. 64% of Medicare beneficiaries love their Tier 1 costs. But for those needing specialty drugs, the system breaks down. Only 49% of people in five-tier plans are satisfied, compared to 68% in three-tier plans. The real winners? The PBMs and drugmakers who negotiate those rebates. The real losers? Patients who can’t afford their meds - and the doctors who have to play guesswork to keep them healthy.What’s Changing in 2025?

The Inflation Reduction Act of 2022 changed things. Now, Medicare beneficiaries pay no more than $35 a month for insulin - no matter the tier. That’s a big win. Also, new formularies are starting to shift from “brand vs. generic” to “outcome-based.” Some PBMs are testing tier systems that reward drugs proven to keep people out of the hospital - not just the cheapest ones. By 2025, 45% of commercial plans may use this kind of value-based tiering. That could mean lower costs for drugs that actually improve health - not just lower sticker prices. But for now, the system is still complex, opaque, and uneven. Your best defense? Know your formulary. Check it every time you refill. Ask questions. Don’t pay more than you have to.What’s the difference between a copay and coinsurance in formulary tiers?

A copay is a fixed dollar amount you pay at the pharmacy - like $15 for a Tier 1 drug. Coinsurance is a percentage of the drug’s total cost - like 30% of a $1,000 specialty drug, which means you pay $300. Tier 1-3 usually use copays. Tier 4 and 5 usually use coinsurance, which can be much more expensive.

Can my insurance drop a drug from my formulary without telling me?

Yes. Plans can change their formularies quarterly. They’re required to send you a notice - usually in the mail or online - but many people miss it. Always check your formulary before refilling, especially if you’re on a brand-name or specialty drug.

Why is my generic drug in Tier 2 instead of Tier 1?

Sometimes, a generic drug is placed in Tier 2 if it’s a newer version - like an extended-release formula - or if the manufacturer hasn’t negotiated a good rebate. It’s still generic, but your plan treats it as less preferred. Check if there’s an older generic version that’s cheaper.

How do I get a non-formulary drug covered?

Ask your doctor to submit a formulary exception request. They’ll need to explain why other drugs won’t work for you - maybe you had side effects or it didn’t help. If the medical reason is clear, most plans approve these requests. You can also call your insurer’s pharmacy line for help.

Are there any drugs that are always covered no matter the tier?

Under Medicare Part D, certain drugs must be covered in every plan, like antiretrovirals for HIV and immunosuppressants after organ transplants. For commercial plans, there’s no universal list - but the Inflation Reduction Act now caps insulin at $35 for Medicare patients, regardless of tier. Some states also have laws protecting access to certain medications.

Comments

Jake Kelly

Just checked my formulary last week and my blood pressure med jumped from Tier 1 to Tier 3. No warning. I’m paying $80 a month now instead of $12. This system is broken.

lisa Bajram

Y’all need to start using GoodRx. Like, yesterday. I saved $190 last month on my antidepressant just by switching pharmacies and using their coupon. It’s not magic, it’s just knowing the game. Also, call your insurer and ask for a tier exception - most of them approve if you’re polite and have a doctor’s note. You got this.

Ashlee Montgomery

It’s wild how the same drug can be Tier 1 at one plan and non-formulary at another. No consistency. No transparency. No accountability. The PBMs aren’t intermediaries - they’re gatekeepers with profit motives disguised as cost-saving measures. We’re not patients. We’re data points in a spreadsheet. And the worst part? The people who need these drugs the most are the ones getting priced out. This isn’t healthcare. It’s a market experiment with human lives.

Paul Bear

Let’s be clear: the tier system is a classic example of incentive misalignment. PBMs extract rebates from manufacturers in exchange for preferred placement, which distorts prescribing patterns. Clinicians are pressured to choose drugs based on rebate size, not clinical appropriateness. The result? A suboptimal therapeutic landscape where patients suffer from therapeutic inertia. It’s not just expensive - it’s medically irresponsible.

Michael Marchio

Look, I get it - generics are cheaper. But not all generics are created equal. I was on a generic version of my asthma inhaler that made me shake like a leaf. Switched back to the brand - same active ingredient, different fillers, different bioavailability. My doctor said it’s not supposed to matter, but my lungs don’t care about the FDA’s equivalence guidelines. They just want to work. So yeah, Tier 1 isn’t always the answer. Sometimes, the system punishes the people who actually need the drug to function, not just survive. And then they wonder why adherence is so low.

And don’t even get me started on how formularies change mid-year. I had a drug covered for three years. One day, boom - Tier 4. No explanation. No grace period. Just a letter in the mail I didn’t open because I assumed it was another bill. By the time I checked, I was 3 weeks without meds. That’s not a policy. That’s negligence dressed up as fiscal responsibility.

And the worst part? You can’t even compare prices across plans. Each one uses different naming conventions, different tiers, different thresholds. It’s like trying to navigate a maze where the walls move every time you blink. And we’re supposed to be empowered consumers? Please. We’re victims of a system designed to confuse us into submission.

Oh, and don’t tell me to ‘ask my doctor.’ My doctor doesn’t have time to look up every drug in every plan. He’s got 12 patients an hour. He’s not a pharmacist. He’s not a PBM analyst. He’s a human trying to keep people alive while drowning in paperwork. Blaming the provider is just another way to avoid fixing the real problem: the corporate greed behind the scenes.

And yes, I’ve used GoodRx. It helped. But only because I was lucky enough to have a job that lets me pay out of pocket. What about the people who can’t? The ones who choose between insulin and groceries? That’s not a cost-sharing issue. That’s a moral failure.

Jaqueline santos bau

So I just found out my insulin is now Tier 2? After 5 years of Tier 1? And they didn’t even email me? I had to find out because my card got declined at CVS. I cried in the parking lot. I’m not exaggerating. I just stood there holding my prescription like a criminal. And now I have to beg my doctor to fight for me? Like I’m asking for a favor? This isn’t healthcare. It’s extortion with a side of bureaucracy.

Aurora Memo

My mom is on Medicare and had to switch from her usual diabetes med because it got kicked off formulary. She didn’t understand why. I helped her file the exception. Took three weeks. They approved it. But she was so scared she almost stopped taking it. We need better communication. Not just forms. Real support. People are scared. They don’t know who to trust. And no one’s explaining it to them in plain language.

neeraj maor

Ever wonder why all the big drug companies are in the same zip code as the PBM headquarters? Coincidence? I don’t think so. This is a cartel. The formulary tiers are a smokescreen. The real game is rebates paid under the table. Your ‘savings’? They’re not yours. They’re going to the CEOs and shareholders. Meanwhile, you’re stuck paying $90 for a pill that should cost $5. And the government lets them do it because they’re too busy taking donations to care. This isn’t capitalism. It’s feudalism with a pharmacy counter.

Ritwik Bose

Thank you for this detailed breakdown. 🙏 As someone from India, I’ve seen how healthcare access varies drastically across systems. In the U.S., the complexity feels overwhelming, but your explanation made it clearer. I hope more people take the time to understand their formularies - knowledge is power, especially when your health is on the line. 🌍💊

Kunal Majumder

Bro, I just started a new job and my new insurance has a different formulary. I had to switch my anxiety med from a Tier 1 to a Tier 3. Paid $120 instead of $15. I called the pharmacy, asked if there’s a cheaper generic - they said yes, but it’s not on formulary. So I used GoodRx and got it for $22. Life hack. Don’t let them scare you into paying more.

chandra tan

In India, we don’t have tiers. We have cash. You pay what you can. Sometimes it’s cheap, sometimes it’s expensive. But at least you know the price before you buy. No forms. No exceptions. No surprise bills. Maybe the U.S. needs less bureaucracy and more honesty.

Dwayne Dickson

Let’s be honest: the entire tiered formulary system is a masterclass in behavioral economics disguised as cost containment. The PBM manipulates consumer choice through asymmetric information and tiered price discrimination - all while claiming to ‘promote value-based care.’ The irony is palpable. When patients are forced into suboptimal therapeutic pathways due to financial incentives embedded in formularies, the term ‘patient-centered care’ becomes an oxymoron. And yet, we’re expected to applaud this as innovation. I’m not impressed. I’m furious.