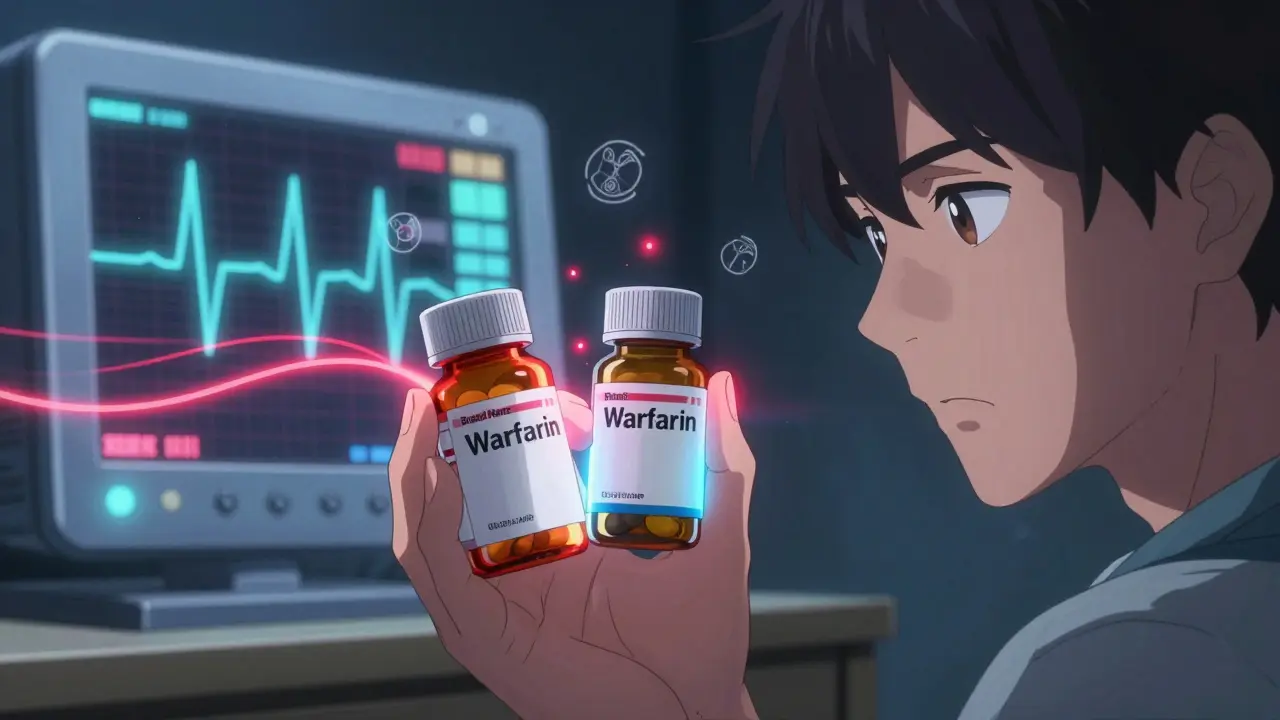

When a patient switches from a brand-name drug to a generic, they expect the same effect-no more, no less. But for NTI generics, that expectation is anything but simple. Narrow Therapeutic Index drugs have a razor-thin line between a therapeutic dose and a toxic one. A 5% difference in blood concentration can mean the difference between control and crisis. That’s why regulatory agencies around the world treat these drugs differently-and why the rules vary wildly from country to country.

What Makes NTI Drugs So Risky?

NTI drugs include warfarin, phenytoin, digoxin, levothyroxine, and lithium. These aren’t obscure medications-they’re staples in heart care, epilepsy treatment, and thyroid management. But their safety profile is fragile. Take warfarin: too little and a patient risks a clot; too much and they bleed internally. Phenytoin? A slight spike can cause dizziness, tremors, or even coma. That’s why bioequivalence standards for these drugs can’t follow the same 80-125% range used for most generics.

The FDA defines NTI drugs as those where small changes in blood concentration can lead to serious therapeutic failure or adverse reactions. That’s not theoretical. In 2021, a generic antihypertensive was recalled due to nitrosamine impurities-contaminants that can form during manufacturing and are especially dangerous in drugs with low safety margins. For NTI generics, there’s no room for error.

How the FDA Handles NTI Generics

The U.S. Food and Drug Administration tightened its rules for NTI generics in 2010, after years of clinical reports showing inconsistent outcomes after generic switches. Today, the FDA requires stricter limits: quality assays must fall within 95-105% of the brand-name drug’s potency, compared to 90-110% for regular generics. Bioequivalence studies must meet tighter criteria-often 90-111% instead of the standard 80-125%.

Studies must use healthy volunteers, not patients, to isolate formulation differences from disease-related variables. And the FDA doesn’t just rely on average bioequivalence anymore. For some drugs, they’re moving toward population bioequivalence models-looking at how the entire group responds, not just the mean. This shift, expected to roll out by 2025, will better capture variability in absorption across different patients.

But even with these rules, 22% more NTI generic applications get rejected than non-NTI ones. Why? Because the data has to be flawless. A single out-of-spec dissolution point, a minor impurity, or an inconsistent release profile can sink an application. Development costs? $5-7 million. Timeline? 18-24 months. That’s nearly double the investment of a standard generic.

The European Union: Fragmented but Strict

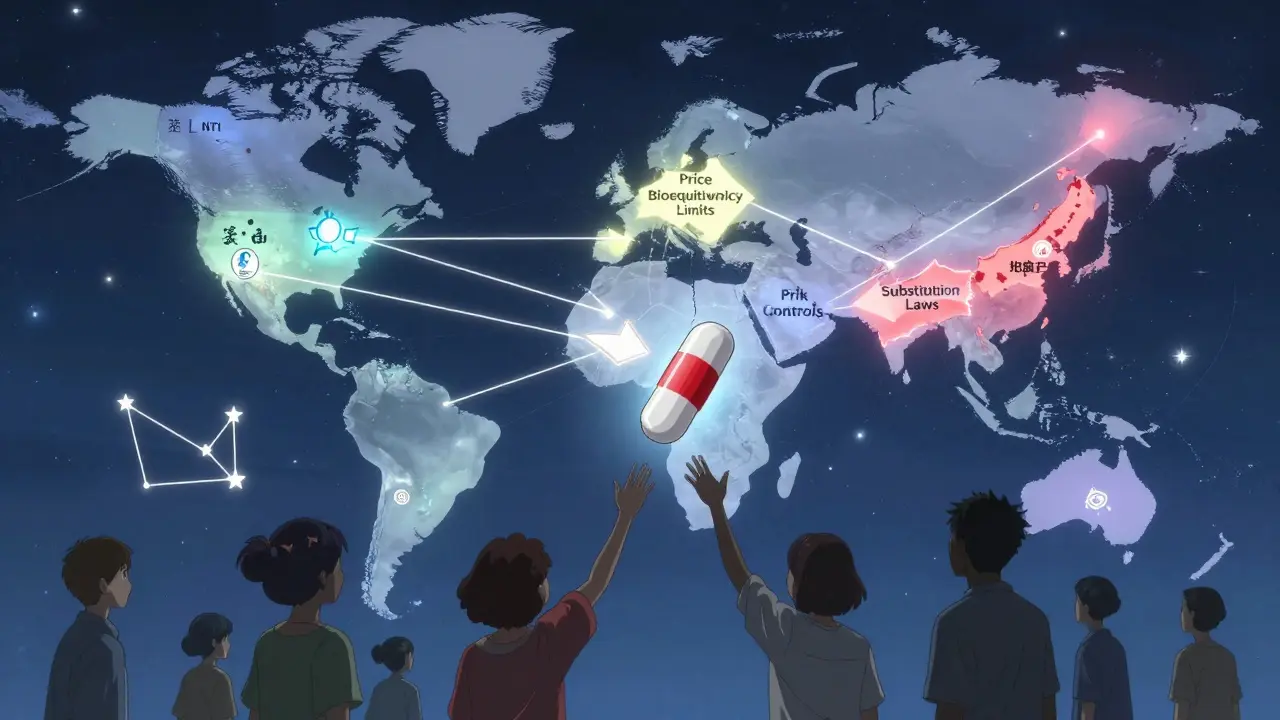

In Europe, the picture is more complex. The European Medicines Agency (EMA) offers three paths to approval: the Centralized Procedure (CP), National Procedure (NP), and Mutual Recognition or Decentralized Procedures. Only about 68% of new generic applications now use the CP, up from 42% in 2018-showing a push toward harmonization.

Like the FDA, the EMA demands tighter bioequivalence limits for NTI drugs, but doesn’t always specify exact numbers publicly. Instead, they rely on case-by-case assessments. The agency also requires comprehensive dissolution profiles across multiple pH levels and conditions, especially for modified-release formulations. Stress testing under high heat and humidity is mandatory.

But regulation doesn’t stop at approval. Pricing is where Europe diverges sharply from the U.S. In 24 of 27 EU countries, governments set generic prices, often forcing the first NTI generic to launch at least 40% below the brand. In Spain, subsequent generics must match or undercut that price. This drives fierce competition-and lower costs for patients-but also creates pressure to cut corners on quality.

And then there’s the patchwork of substitution laws. While the EMA approves the drug, individual countries decide whether pharmacists can switch patients automatically. In Germany, substitution is allowed with physician notification. In France, it’s banned for certain NTI drugs. Pharmacists in the EU report 58% confusion over these rules, especially when a drug was approved through a decentralized process across multiple countries.

Canada, Japan, and the Global Patchwork

Health Canada takes a flexible but cautious approach. It allows foreign-sourced reference products in bioequivalence studies-if the product matches the brand in solubility, formulation, and physicochemical properties. They also require multi-point dissolution profiles, which help detect subtle differences in release patterns.

Japan’s PMDA has detailed guidance for topical NTI drugs, a niche but growing area. Their standards are among the most rigorous globally, with strict limits on impurities and particle size distribution. They also require long-term stability data under real-world conditions, not just accelerated testing.

Meanwhile, many countries-including Brazil, Mexico, Singapore, and South Korea-lack specific NTI guidance. That creates a dangerous gap. A generic approved in one country may be rejected in another, not because it’s unsafe, but because the regulatory framework doesn’t exist to evaluate it properly.

The Real-World Impact: Patients and Providers

Behind every regulation is a patient. In the U.S., 67% of pharmacists say they’ve been asked by doctors to avoid substituting generics for NTI drugs. Anti-epileptic drugs and warfarin top the list. On Reddit, pharmacists share stories: patients on levothyroxine whose TSH levels spiked after a generic switch-even though the FDA deemed it equivalent.

But it’s not all fear. A 2021 study of 12,500 patients across 15 European countries found that when strict bioequivalence criteria were met, 94.7% of NTI generic switches resulted in equivalent clinical outcomes. The key word? Strict.

State laws in the U.S. add another layer. Twenty-six states require special consent or notification before substituting NTI generics. North Carolina demands written approval from both physician and patient. Connecticut, Idaho, and Illinois have extra rules for anti-seizure drugs. These aren’t bureaucratic hurdles-they’re safeguards. But they also slow access and increase administrative burden.

Who’s Leading the Market?

Despite the barriers, the NTI generics market is growing fast-projected to hit $72.3 billion by 2027. The U.S. accounts for 42% of sales, Europe for 34%. Teva leads with nearly 19% global market share, followed by Mylan, Sandoz, and Hikma.

But market share doesn’t tell the whole story. Warfarin generics have 92% penetration in the U.S. Levothyroxine? Only 67%. Why? Prescriber hesitation. Even when the science says it’s safe, trust is hard to earn.

What’s Changing? The Push for Global Alignment

Efforts to harmonize standards are gaining momentum. The International Generic Drug Regulators Pilot (IGDRP), launched in 2012, now includes regulators from the U.S., EU, Canada, Japan, Switzerland, and others. They’re sharing data, aligning testing protocols, and building mutual recognition.

ICH M9, adopted in June 2023, introduces biowaivers based on biopharmaceutics classification-potentially speeding up approvals for some NTI drugs without compromising safety. The FDA’s GDUFA III, effective in 2023, adds enhanced post-market surveillance for NTI generics, including real-world data collection and adverse event tracking.

Experts predict that by 2030, international collaboration could cut approval times by 25-30%. But challenges remain. Modified-release NTI formulations, which make up 23% of the market, still lack consistent global standards. And while harmonization is the goal, cultural and economic differences-like price controls in Europe versus patent litigation in the U.S.-will keep the landscape uneven.

What Does This Mean for You?

If you’re a patient on an NTI drug: know your medication. Ask your pharmacist if your generic is from the same batch as your previous one. If your levels fluctuate after a switch, speak up. It’s not paranoia-it’s precision medicine.

If you’re a prescriber: understand your state’s substitution laws. Don’t assume all generics are interchangeable. Use therapeutic drug monitoring when possible. And if you’re skeptical of a generic, you’re not alone-but the data is improving.

If you’re in pharma: don’t cut corners. The cost of failure isn’t just a rejected application-it’s a patient’s life. Invest early in dissolution modeling, stress testing, and regulatory consultation. Engage with the FDA’s Complex Generic Drug Product Development Meetings or EMA’s Scientific Advice program. Those 30-45 days saved early can mean the difference between market entry and years of delays.

The global system for NTI generics is far from perfect. But it’s evolving. And for the millions who rely on these drugs, every tightening of a standard, every shared dataset, every aligned guideline brings us closer to safe, affordable, and reliable access-no matter where they live.

Comments

James Castner

The regulatory fragmentation surrounding NTI generics isn't just bureaucratic inefficiency-it's a systemic failure of risk management in global public health. The FDA’s 95-105% bioequivalence window, while scientifically rigorous, is a Band-Aid on a hemorrhage. We’re treating pharmaceutical equivalence like a math problem when it’s fundamentally a biological one. Patients aren’t test tubes; their gut microbiomes, hepatic enzyme polymorphisms, and even circadian rhythms alter drug absorption in ways that standardized dissolution profiles can’t capture. And yet, we’re still relying on healthy volunteers in controlled labs to predict outcomes in elderly polypharmacy patients with renal impairment. That’s not science-it’s arrogance dressed in white coats.

Meanwhile, the EMA’s case-by-case approach is equally flawed. Without transparent, publicly accessible thresholds, manufacturers are left guessing. One company spends $7 million only to get rejected because ‘the dissolution profile didn’t align with the reference product’s variability under gastric pH 5.2’-but no one ever told them that was the issue. This isn’t regulation; it’s regulatory black box capitalism.

And let’s not pretend price controls in Europe are altruistic. They’re a form of state-enforced cost-shifting. When Spain forces subsequent generics to undercut the first entrant by 40%, you’re not lowering prices-you’re incentivizing corner-cutting on excipients, packaging integrity, and stability testing. The patient wins on the pharmacy counter, but loses in the ER when their lithium level spikes because the tablet disintegrated too fast in their dry mouth.

ICH M9’s biowaivers? A dangerous gamble. Biopharmaceutics classification assumes uniform absorption pathways, but NTI drugs like levothyroxine are notoriously sensitive to food interactions, gastric emptying time, and even the pH of bottled water used to swallow them. A biowaiver might save six months on approval-but it could cost someone their life.

The real tragedy? We have the tools-real-world evidence platforms, pharmacokinetic modeling, population bioequivalence-but we’re too afraid to implement them at scale. Regulatory agencies cling to legacy methods because they’re familiar, not because they’re safe. And until we treat drug equivalence as a dynamic, patient-centered problem-not a static, lab-based checkbox-we’re just rearranging deck chairs on the Titanic.

Gregory Parschauer

Oh please. You think the FDA’s 95-105% rule is the problem? It’s the pharma giants who’ve turned NTI generics into a monopoly game. Teva, Sandoz-they’re not ‘innovating,’ they’re gaming the system. They’ll spend $7 million to get approval, then jack up prices the second the patent expires. And don’t get me started on the ‘bioequivalence’ studies. Healthy volunteers? In a lab? Please. Real patients aren’t 25-year-old college kids on a $500 stipend. They’re 72-year-olds on six meds, with a liver that’s seen better days. The FDA knows this. They just don’t care enough to fix it.

And now you want to ‘harmonize’ with the EU? Good luck. Europe’s ‘strict’ rules are just a front for protectionism. They want to keep their local manufacturers alive by making it impossible for American generics to compete. Meanwhile, patients in Brazil and India? They’re getting crap generics with no oversight at all. It’s not a global problem-it’s a capitalist one. Profit over patients. Always.

I’ve seen it. My aunt switched from brand levothyroxine to a generic and ended up in the ER with atrial fibrillation. The pharmacist said ‘it’s the same thing.’ It’s not. It’s never the same thing. And until regulators admit that, people are going to keep dying because someone thought a 5% difference was ‘statistically insignificant.’

lucy cooke

How profoundly banal. You’ve written a 2,000-word treatise on pharmaceutical bioequivalence and yet you’ve entirely omitted the existential horror of it all: we are reducing human life to a chromatogram. A single peak. A single AUC. As if the soul of a patient can be quantified by a number on a screen. We have turned medicine into a spreadsheet. Levothyroxine is not a molecule-it is a trembling hand, a frozen heart, a mind lost in fog. And now, we let a generic manufacturer in Taiwan decide whether that trembling hand will tremble harder-or stop altogether.

The FDA’s 95-105%? A cruel joke. A statistical illusion. A masquerade of precision. We are not engineers. We are not chemists. We are mourners, standing at the edge of a cliff, holding a ruler, trying to measure the wind.

And yet, you speak of ‘harmonization’ as if it were salvation. But harmony is the lie of the powerful. The EMA, the PMDA, the FDA-they are not stewards. They are gatekeepers. And their rules? They are not for the patient. They are for the boardroom.

Rosalee Vanness

Reading this made me want to hug every pharmacist who’s ever hesitated to substitute a generic for a patient on warfarin. Seriously. They’re the unsung heroes here. I’ve worked in pharmacy for 18 years, and I’ve seen patients cry because their TSH jumped after a switch-even though the FDA said it was ‘bioequivalent.’ One woman came in with her lab results in hand, shaking, asking if she was ‘broken now.’

The truth? We don’t have enough data to say these switches are safe for everyone. Not really. The studies are based on averages. But people aren’t averages. Some of us metabolize drugs like racehorses. Others are snails. And for NTI drugs? That difference can be life or death.

My advice? If you’re on one of these meds, stick with the same brand or same generic batch. Don’t let the pharmacist swap it unless you’re 100% sure it’s the same. And if your doctor says ‘it’s fine,’ ask them if they’ve ever had a patient crash after a switch. Chances are, they have. They just never told you.

Also, if you’re in pharma? Stop treating this like a cost-cutting exercise. This isn’t detergent. This is someone’s heartbeat. Invest in the science. Don’t just chase the approval. Chase the trust.

Trevor Davis

Man, I’ve been on levothyroxine for 12 years. Switched generics three times. First time? Felt like I was on a sugar high then crashed hard for a week. Second time? My hair started falling out. Third? Nothing. Weird, right? But I didn’t complain because I’m not a drama queen.

Turns out, my body’s just weird. My pharmacist said the FDA says they’re all the same. But my body says otherwise. So now I just ask for the same one every time. Costs more? Yeah. But I’d rather pay extra than feel like a zombie for a month.

Also, why does no one talk about the fact that some generics use different fillers? Corn starch vs. lactose? Doesn’t sound like a big deal until you’re one of the 10% of people who can’t process one of them. Then suddenly your thyroid meds are making you bloated and exhausted. It’s not the active ingredient. It’s the junk they stick it in.

Milla Masliy

As someone who works in global health policy, I’ve seen firsthand how NTI generic disparities create real inequities. In rural India, patients are getting generics that were never tested for dissolution under acidic conditions-because the local regulator doesn’t require it. Meanwhile, in the U.S., we’re debating whether to use population bioequivalence models. We’re not just out of sync-we’re out of moral alignment.

The IGDRP is a step in the right direction, but it’s still a club for wealthy nations. What about Nigeria? Vietnam? Peru? They don’t have the labs, the funding, or the staff to replicate FDA-grade testing. So they rely on WHO prequalification… which is barely a baseline.

Harmonization isn’t about copying the FDA. It’s about building capacity. We need global funding for regional testing hubs, open-access dissolution databases, and training programs for regulators in low-resource settings. Otherwise, ‘global alignment’ is just a fancy term for ‘we’ll decide what’s safe, and you’ll take it.’

Avneet Singh

Let’s be real. The entire NTI generics debate is a distraction. The real issue is that Big Pharma owns the FDA. Why do you think the approval process takes 24 months? Because they’re milking the system. They want to keep prices high so they can charge $1,200 for a 30-day supply of brand levothyroxine while the generic costs $4. But they can’t just say that, so they invent ‘strict standards’ to scare people away from generics. It’s all a money game.

And don’t get me started on ‘population bioequivalence.’ That’s just corporate jargon for ‘we’re too lazy to test on real patients.’ Use the data from 10,000 people already on these drugs. It’s already out there. Stop pretending you need a new study.

Also, why is Canada allowed to use foreign reference products? That’s just a loophole for cheap imports. The FDA should ban it. But they won’t, because Teva has offices in Toronto.

Angel Molano

Stop pretending this is about science. It’s about money. If a generic saves a patient $50 a month, the system wins. If it kills them? They’re just another statistic. The FDA doesn’t care. The EMA doesn’t care. The patients? They’re just numbers with prescriptions.

Kimberly Mitchell

So let me get this straight: we’re spending $7 million to prove a generic is ‘equivalent’-but we still can’t guarantee it won’t cause a patient to bleed out or seize? That’s not regulation. That’s a Ponzi scheme disguised as pharmacology. And the fact that 22% more NTI applications get rejected? That’s not a sign of rigor. It’s a sign of incompetence. If you can’t define the standard clearly, you shouldn’t be in charge.

Angel Tiestos lopez

Bro. I just switched to a generic warfarin last month. My INR went from 2.4 to 4.1 in 72 hours. I didn’t change anything else. Just the pill. Now I’m on the brand again. Cost me $180 extra. Worth it. Don’t risk your life for $30. 🚨

Alan Lin

There’s a quiet crisis here that no one’s talking about: the psychological toll on patients. When you’re told your medication is ‘equivalent,’ but you feel different, you start doubting your own body. Is it anxiety? Is it aging? Or is it the pill? That uncertainty is its own kind of toxicity. For patients with epilepsy, bipolar disorder, or heart failure, that doubt can be paralyzing.

We need a patient registry-anonymous, secure, global-where people can log their reactions to generic switches. Not just lab values. How they felt. Their sleep. Their mood. Their tremors. That’s the data we’re missing. And until we listen to the patients-not just the chromatographs-we’re flying blind.

And to the regulators: stop treating this like a compliance checklist. This is human vulnerability. Treat it that way.

Adam Vella

The notion that ‘bioequivalence’ can be meaningfully defined for NTI drugs is a fundamental epistemological error. Equivalence implies interchangeability, yet the pharmacokinetic variance inherent in human physiology renders this concept incoherent at the individual level. The statistical models employed by regulatory agencies assume normality, homoscedasticity, and linearity-assumptions violated by the nonlinear absorption dynamics of drugs like phenytoin and lithium. The entire paradigm is built upon a Cartesian illusion of quantifiable uniformity in a profoundly nonlinear biological system.

Furthermore, the reliance on healthy volunteers as surrogates for clinically complex populations constitutes a methodological fallacy of ecological invalidity. The pharmacodynamic response of a geriatric patient with polypharmacy and renal insufficiency cannot be extrapolated from the pharmacokinetic profile of a 22-year-old male with no comorbidities.

Until regulatory science transcends its reductionist roots and embraces complexity theory, systems biology, and individualized pharmacometrics, all ‘standards’ are merely artifacts of institutional inertia masquerading as scientific authority.

Adam Rivera

Hey, I’m a pharmacist in Ohio. I’ve been doing this for 15 years. Here’s the thing: most patients don’t care about the FDA’s 95-105% rule. They care if they feel weird after a switch. And honestly? Sometimes they do. I’ve had patients tell me, ‘I know it’s the same drug, but it just doesn’t feel right.’ And you know what? I believe them.

I don’t switch NTI generics unless the patient says it’s fine. And even then, I check in a week later. No one’s ever thanked me for it. But I’ve had people say, ‘You’re the only one who actually listened.’

So yeah, the rules are messy. The science is complicated. But the human part? That’s simple. Listen. Care. Don’t assume.

Nelly Oruko

i just got my thyroid med switched and now i feel like a zombie… but the dr says its ‘bioequivalent’ so i guess im just tired? 😔

Pankaj Singh

Everyone’s acting like this is a breakthrough. It’s not. It’s a $7 million shell game. The real problem? The FDA and EMA are just glorified paper-pushers. They approve drugs based on paperwork, not outcomes. The fact that 22% of NTI applications get rejected means they’re not even trying. They’re just waiting for someone to fail so they can look tough. Meanwhile, patients are dying in the gaps.

And don’t even get me started on ‘global harmonization.’ That’s just a fancy way of saying ‘we’re exporting American regulatory failure to the rest of the world.’